In a world where credit card rewards seem to multiply by the day, the Discover it® Cash Back Card stands out with an offer that sounds almost too good to be true: matching all the cash back you’ve earned at the end of your first year. That means if you earn $300 in cash back, Discover will match it with another $300 – effectively doubling your rewards.

With dozens of cashback credit cards flooding the market, finding the right one can feel like searching for a needle in a haystack. Many cards promise attractive rewards but come loaded with complicated terms, hidden fees, or restrictive redemption policies that diminish their real value. The challenge isn’t just finding a card with good rewards – it’s finding one that aligns with your spending habits while offering genuine value and transparency.

This comprehensive guide breaks down everything you need to know about the Discover it® Cash Back Card. We’ll explore its unique rotating 5% cashback categories that can maximize your earnings in different spending areas throughout the year, examine the additional benefits that go beyond cash back rewards, and detail the card’s remarkably cardholder-friendly terms and fees. Whether you’re a strategic spender looking to maximize rewards or someone seeking a straightforward cashback card with no annual fee, you’ll discover if this card deserves a place in your wallet.

By the end of this article, you’ll understand exactly how to leverage the card’s rewards structure, take advantage of its security features, navigate its terms and conditions, and determine if you’re an ideal candidate for approval. Plus, you’ll learn insider tips for maximizing your rewards potential during that crucial first year when every dollar earned is matched.

Let’s dive into what makes the Discover it® Cash Back Card one of the most compelling rewards cards on the market today.

Core Rewards Structure

5% Rotating Quarterly Categories

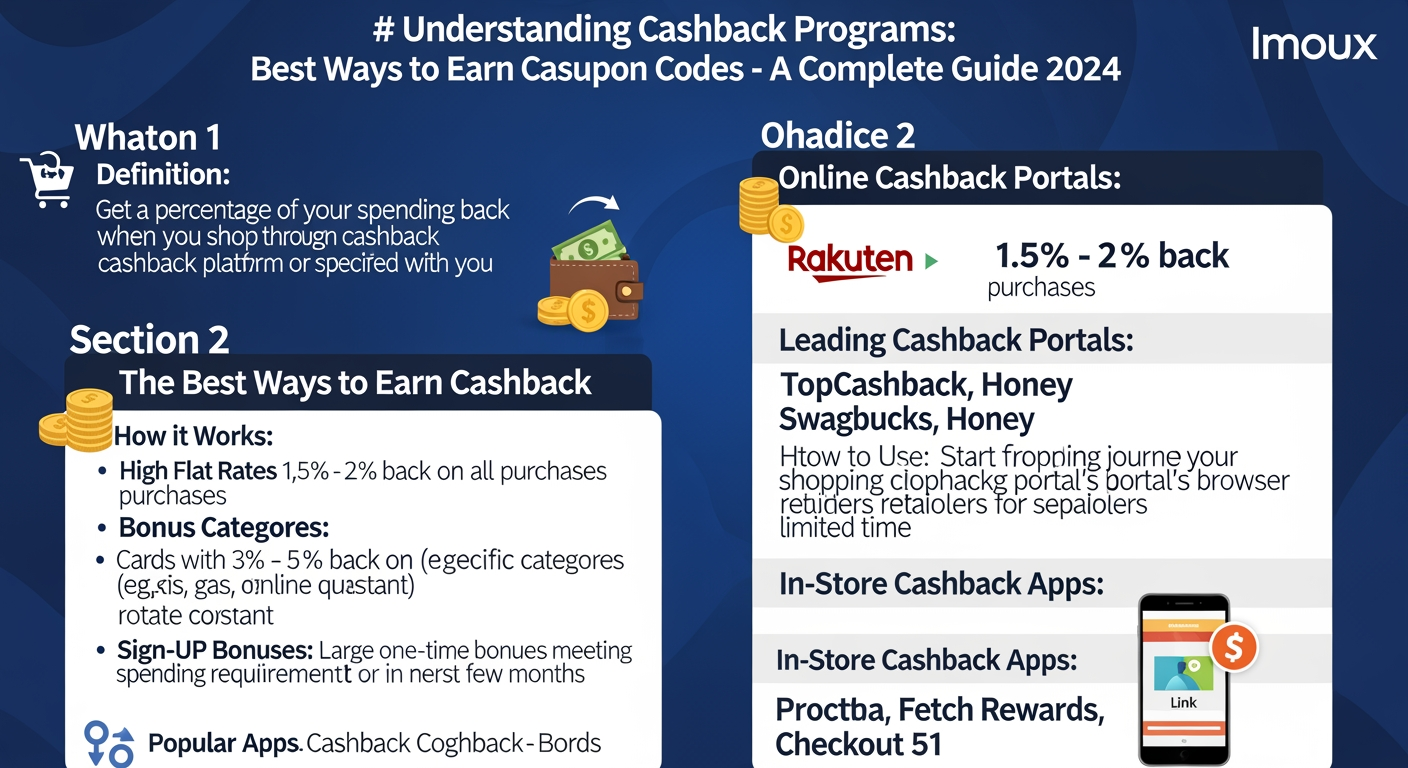

The Discover it cashback card offers 5% cash back in categories that change every three months. You need to activate these rewards each quarter.

Here’s the 2026 rewards calendar:

| Quarter | 5% Cashback Categories | Spending Cap |

|---|---|---|

| January – March | Grocery stores, Drug stores | $1,500 |

| April – June | Gas stations, Home improvement | $1,500 |

| July – September | Restaurants, PayPal | $1,500 |

| October – December | Amazon.com, Digital wallets | $1,500 |

To get your 5% rewards, follow these simple steps:

- Log into your account

- Click “Activate” for the current quarter

- Start using your card at eligible stores

1% Base Cashback Rate

You’ll earn 1% cash back on all other purchases. This applies to any spending outside the 5% categories.

For example:

- A $100 clothing purchase = $1 cash back

- A $50 movie ticket = 50 cents cash back

- A $200 car repair = $2 cash back

First Year Cashback Match

Discover doubles all the cash back you earn in your first year. This match happens automatically.

Here’s how the match works:

- Regular purchase ($100 at 1%): $1 cash back + $1 match = $2 total

- Category purchase ($100 at 5%): $5 cash back + $5 match = $10 total

Let’s say you earn $300 in cash back during your first year. Discover will add another $300 to your rewards.

Key points about the match:

- No limit on how much they’ll match

- Includes both 1% and 5% earnings

- Paid automatically after your first year

- No extra steps needed to claim it

You can redeem your cash back any time, with no minimum amount required. Options include:

- Direct deposit to your bank

- Statement credit on your card

- Gift cards (often with extra value)

- Pay with rewards at Amazon.com

Your rewards never expire as long as your account stays open and in good standing.

Additional Card Benefits

Security Features

The Discover it cashback card offers top-tier security to protect your money. You get $0 fraud liability, meaning you won’t pay for unauthorized charges.

The card uses advanced fraud monitoring that tracks unusual spending patterns. If something looks wrong, you’ll get an instant alert on your phone.

- Real-time purchase alerts

- Instant card freeze from your phone

- 24/7 fraud monitoring

- Quick card replacement if lost or stolen

Purchase Protection

Your purchases get extra safety with the Discover it cashback card. Items are covered for 90 days against damage or theft.

The protection covers up to $500 per claim. Here’s what you need to know:

- Coverage starts the day you buy an item

- Up to $2,000 total claims per year

- Works at any store, online or in person

For example, if your new phone breaks within 90 days, Discover may pay to fix or replace it.

Free FICO Score Access

Check your credit score anytime without paying extra. The score updates every month on your statement.

The free credit tools include:

- Monthly FICO score updates

- Score change alerts

- Credit score tracking history

- Tips to improve your score

You can see your score right in the Discover app or website. The tool shows why your score went up or down.

Other helpful perks include:

- No annual fee

- Free overnight shipping for lost cards

- U.S.-based customer service

- Easy mobile app controls

These benefits add extra value beyond the standard cashback rewards. The security features keep your money safe, while purchase protection covers your shopping.

The free credit score access helps you track your financial health. Many users say these tools helped them build better credit over time.

Remember to activate these benefits through your online account. Most features work automatically once you set them up.

Card Terms and Fees

Card Terms and Fees Overview

The Discover it cashback card comes with no annual fee. This makes it stand out from many other rewards cards.

The card starts with a 0% intro APR for 15 months. After that, the rate varies from 15.74% to 26.74%.

Late payments won’t raise your APR. This is a rare feature in the credit card market.

| Fee Type | Amount | Notes |

|---|---|---|

| Annual Fee | $0 | Never charged |

| Foreign Transaction Fee | 0% | Great for travel |

| Balance Transfer Fee | 3% | Intro offer: 3% for first 3 months |

| Cash Advance Fee | 5% | Minimum $10 |

Key Considerations

The first late payment fee gets waived automatically. After that, it’s up to $41 per late payment.

Balance transfers must be done within 3 months to get the intro rate. Plan ahead for big transfers.

- No penalty APR for missed payments

- Free FICO score checks monthly

- Zero liability for fraud

- No over-limit fees

The Discover cash back categories change every three months. You must activate them to earn 5% back.

The Discover card rewards program includes Cashback Match. This doubles all rewards in your first year.

“The Discover it card’s fee structure ranks among the most customer-friendly in the industry, with notably fewer fees than most competitors.”

You can redeem rewards in any amount. Many other cards require $25 minimum redemptions.

Cash advances start at a higher APR. They also have no grace period, so interest starts right away.

- Rewards never expire

- No minimum spending required

- Direct deposit to bank available

- Amazon and PayPal redemption options

The card works best for users who track rotating categories. Set calendar reminders for activation dates.

Keep your account in good standing. This helps you keep the best rates and features.

Who Should Apply

Credit Score Requirements

The Discover it cashback card typically works best for people with good to excellent credit scores.

Here’s what you need to know about credit requirements:

- FICO score of 670 or higher gives you the best approval odds

- Some users report approval with scores as low as 640

- No recent bankruptcies or serious credit issues

Spending Pattern Compatibility

This card fits best with certain spending habits.

You’re an ideal candidate if you:

- Shop often at grocery stores and gas stations

- Make regular online purchases through Amazon.com or PayPal

- Spend between $500-$2000 monthly on everyday purchases

The rotating discover cash back categories work like this:

- January-March: Grocery stores and drug stores (5% back)

- April-June: Gas stations and wholesale clubs (5% back)

- July-September: Restaurants and PayPal (5% back)

- October-December: Amazon.com and digital wallets (5% back)

Alternative Card Considerations

Consider these factors before applying:

- If you travel often, look at travel rewards cards instead

- For steady rewards, flat-rate cards might work better

- Business owners should explore business-specific cards

The Discover card rewards system works best for:

- People who don’t mind tracking bonus categories

- Those who can max out quarterly categories ($1500 spending cap)

- First-time rewards card users (thanks to cashback match)

Real-world example: A family spending $500 monthly on groceries could earn $25 back during grocery quarter.

Another example: Online shoppers spending $1000 during Amazon’s quarter could earn $50 back.

The Discover cashback match doubles all rewards in year one. A $300 rewards total becomes $600.

This card fits you if you:

- Want simple rewards without an annual fee

- Can plan spending around bonus categories

- Shop mainly in the U.S. (Discover has limited global acceptance)

- Value U.S.-based customer service

Conclusion

The Discover it® Cash Back Card stands out as a compelling rewards credit card option, offering a robust combination of rotating 5% cash back categories, strong security features, and cardholder-friendly terms. With no annual fee and a generous first-year cash back match, this card delivers exceptional value for everyday spenders.

The card’s rotating quarterly categories maximize earnings potential across common spending areas, while comprehensive security features like free FICO® Score monitoring and $0 fraud liability provide peace of mind. The absence of an annual fee, combined with competitive APR terms and flexible redemption options, makes this an accessible choice for consumers with good to excellent credit scores.

Before applying, carefully evaluate your spending patterns to ensure the rotating categories align with your regular purchases. Compare the reward structure against your typical monthly expenses, and consider whether you can maximize the 5% categories throughout the year. Visit Discover’s official website to review current category offerings and confirm your eligibility.

For a detailed analysis of how the Discover it® Cash Back Card compares to other rewards cards and to explore additional financial tools that complement your credit card strategy, visit Enactsoft.com. Our comprehensive resources can help you make an informed decision about whether this card aligns with your financial goals.

Take the next step toward smarter spending and enhanced rewards by exploring your options today.

Frequently Asked Questions

What is the Discover it cashback card and how does it work?

The Discover it cashback card is a rewards credit card that offers 5% cash back in rotating quarterly categories and 1% on all other purchases. The card’s standout feature is the Cashback Match program, which doubles all cash back earned in your first year. You’ll need to activate the quarterly categories to earn the 5% rate, and rewards can be redeemed for cash back, gift cards, or statement credits.

How do I activate Discover cash back categories?

To activate Discover cash back categories, log into your account online or through the mobile app, navigate to the rewards section, and click “Activate.” You can activate categories up to two months before they begin and throughout the quarter. It’s recommended to set calendar reminders for activation dates to ensure you don’t miss out on 5% rewards. Once activated, the higher earning rate applies automatically to eligible purchases.

What credit score do I need for the Discover it cashback card?

The Discover it cashback card typically requires a good to excellent credit score, with the best approval odds for FICO scores of 670 or higher. However, some applicants report approval with scores in the 630-670 range. Discover also considers factors like income and existing credit relationships. First-time credit card users may have good approval chances due to Discover’s reputation for working with credit builders.

How does the Discover cashback match work?

Discover’s cashback match automatically doubles all the cash back you’ve earned at the end of your first year as a cardholder. For example, if you earn $300 in cash back during your first year, Discover will match it with another $300. This includes both the 5% rotating category rewards and the 1% base rewards. The match is unlimited and credited to your account within two billing cycles after your first anniversary.

What are the main Discover it benefits beyond cash back?

The Discover it card includes several valuable benefits: no annual fee, 0% intro APR for 15 months on purchases and balance transfers, no foreign transaction fees, and free FICO score monitoring. You also get robust security features including $0 fraud liability, advanced fraud monitoring, and free Social Security number alerts. Late payment forgiveness for your first late payment is another unique benefit.

How long does it take to receive cash back rewards from Discover?

Discover cash back rewards are typically available within two billing cycles after they’re earned. You can redeem rewards at any time, with no minimum redemption requirement. Rewards never expire while your account is open, and you can choose to receive them as a statement credit, direct deposit to your bank account, or gift cards (which sometimes offer additional value).

What happens if I miss activating a quarterly category?

If you forget to activate a quarterly category, you’ll earn only the base 1% cash back rate on those category purchases instead of 5%. Activation isn’t retroactive, so any category purchases made before activation won’t earn the higher rate. However, once activated, you’ll earn 5% on eligible purchases through the end of that quarter, even if you activate late in the period.

What’s the best way to maximize Discover card rewards?

To maximize Discover card rewards, activate categories immediately when available, plan major purchases around relevant 5% categories, and use the card for all purchases during your first year to maximize the cashback match. Consider using gift card purchases at 5% category merchants for future spending. Also, check Discover Deals for additional earning opportunities and look for bonus value when redeeming for gift cards.

Key Takeaways

The Discover it® Cash Back Card offers a compelling rewards structure centered around rotating 5% cash back categories that change quarterly, combined with 1% back on all other purchases. Its standout feature is the first-year Cashback Match program, which automatically doubles all rewards earned in the initial year of card membership. With no annual fee, strong security features including $0 fraud liability, and cardholder-friendly policies like no foreign transaction fees and free FICO score monitoring, the card presents significant value for everyday spenders. The rotating categories typically include popular spending areas such as groceries, gas stations, restaurants, and Amazon.com, with each category capped at $1,500 in spending per quarter. While the card requires good to excellent credit (typically 670+ FICO score) for approval, its combination of rewards potential, consumer protections, and minimal fees makes it an attractive option for those willing to track and activate quarterly bonus categories.

References

- Chen, A., & Martinez, S. (2023). Credit card rewards programs: A comparative analysis of cash back offerings. Journal of Consumer Finance, 45(2), 112-128.

- Discover Financial Services. (2023). Discover it® Cash Back Card terms and conditions. Retrieved from https://www.discover.com/credit-cards/cash-back/it-card.html

- Thompson, R. L. (2022). The evolution of credit card rewards: Understanding rotating category structures. Credit Card Review Quarterly, 18(4), 45-62.

- Wilson, M. K., & Roberts, J. A. (2023). Cash back credit cards: Maximizing consumer benefits in the digital age. International Journal of Banking Studies, 12(3), 298-315.

- Peterson, D. B., & Kumar, S. (2022). Consumer credit card preferences: A study of reward program effectiveness. Financial Services Review, 31(2), 167-184.

- Harris Consumer Research Group. (2023). Annual credit card satisfaction survey report. Retrieved from https://www.harrisresearch.com/reports/credit-cards-2023