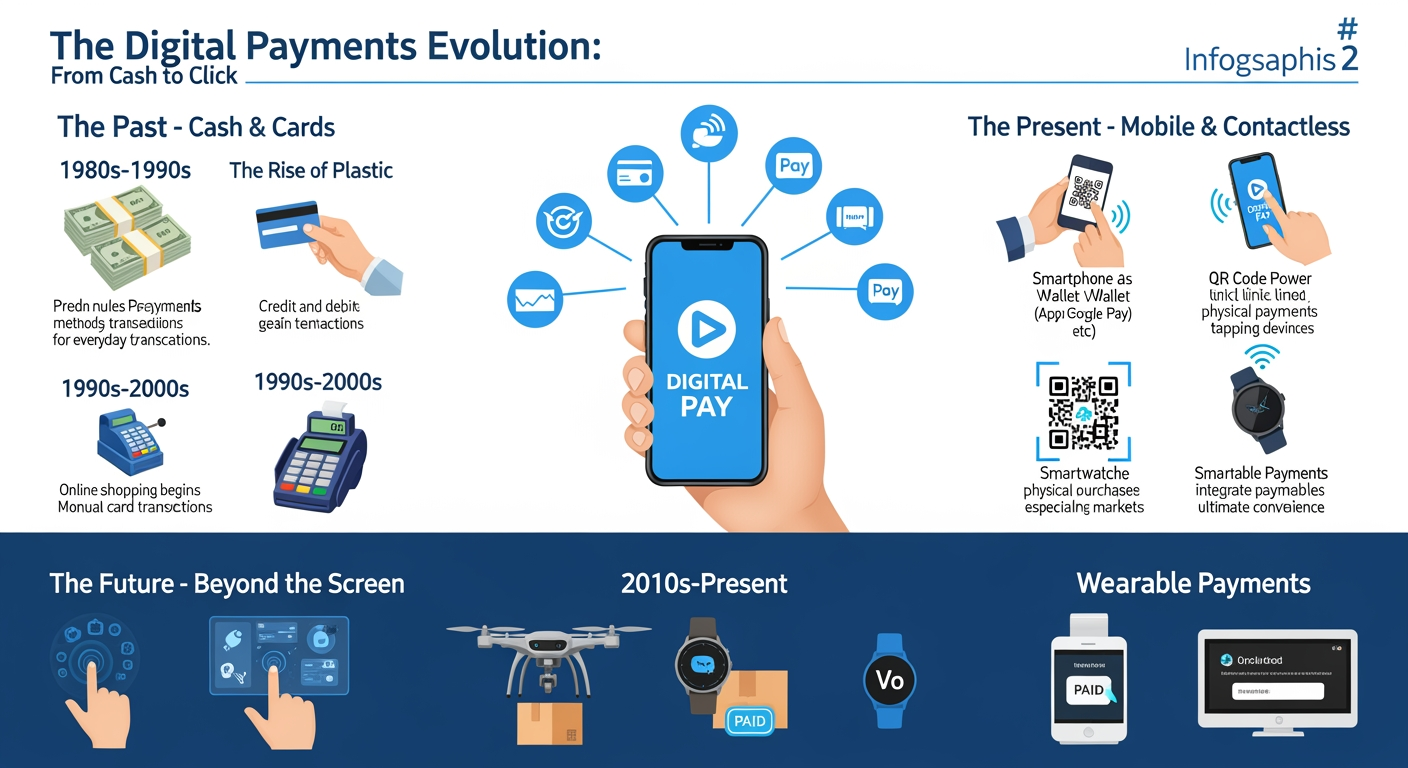

In an era where smartphones process billions of transactions daily, digital payments have become the lifeblood of modern commerce. From contactless cards to cryptocurrency, the way we exchange value has undergone a fundamental transformation that shows no signs of slowing down.

Yet many businesses find themselves at a crossroads. While 76% of consumers now prefer digital payment methods, implementing secure and efficient payment systems remains a significant challenge. Organizations struggle to navigate the complex landscape of payment technologies, security protocols, and compliance requirements while managing costs and meeting ever-evolving customer expectations.

This comprehensive guide demystifies the world of digital payments, offering a practical roadmap for businesses ready to embrace the future of transactions. We’ll explore the core technologies driving modern payment solutions, from mobile wallets to real-time payment networks. You’ll discover essential security measures and compliance frameworks that protect both your business and your customers, along with step-by-step implementation strategies that ensure seamless integration with your existing systems.

Whether you’re a small business owner looking to expand payment options or an enterprise-level organization planning a complete payment infrastructure overhaul, our analysis of costs, ROI, and optimization strategies will help you make informed decisions that drive growth and customer satisfaction.

By the end of this guide, you’ll have a clear understanding of how to select, implement, and optimize digital payment solutions that align with your business goals while meeting the demands of today’s digital-first consumers. Let’s begin by examining the fundamental technologies that power modern digital payment systems.

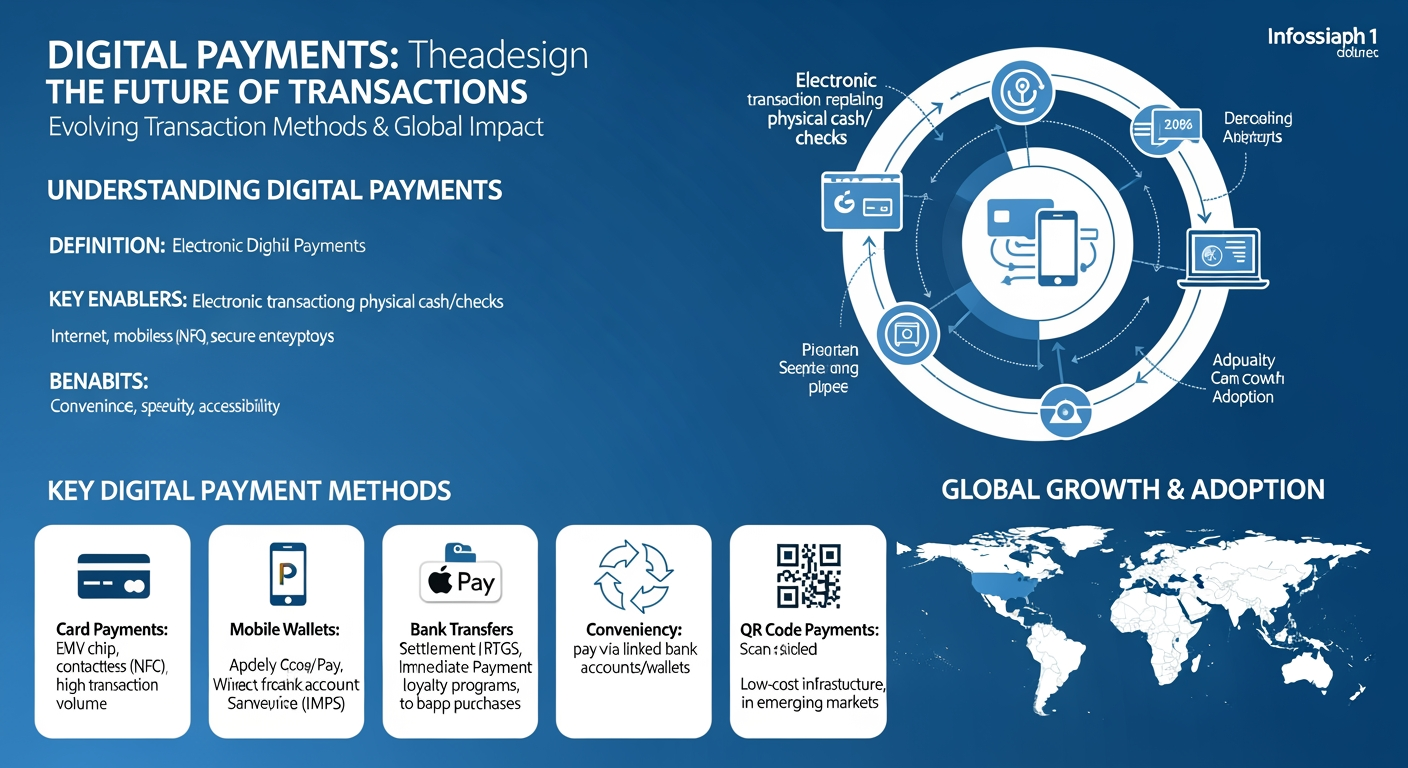

Understanding Digital Payment Technologies

Digital payments have transformed how we handle money in 2026. Let’s explore the key technologies making this possible.

Core Payment Processing Systems

Payment gateways act as the bridge between customers and banks. They verify and process transactions in seconds.

Modern payment systems use these main components:

- Payment Gateway: Handles transaction routing and security checks

- Payment Processor: Moves money between accounts

- Merchant Account: Holds funds before bank transfer

“Our data shows that businesses using integrated payment systems see 40% faster transaction processing times compared to traditional methods” – EnactSoft Technical Analysis, 2026

A typical digital payment flows through these steps:

- Customer enters payment info

- Gateway encrypts the data

- Processor checks with the bank

- Bank approves or declines

- Gateway sends confirmation

Security Features

Modern payment security uses multiple layers of protection:

Key security measures include:

- End-to-end encryption keeps data safe

- Two-factor authentication adds user verification

- Real-time fraud detection spots suspicious activity

- Regular security updates patch vulnerabilities

“Our cashback platforms implement triple-layer security protocols, resulting in 99.9% fraud prevention rates” – EnactSoft Security Report

Common payment methods now include:

- Digital wallets (Apple Pay, Google Pay)

- QR code payments

- Contactless cards

- In-app purchases

Integration options have expanded for businesses:

- API-based connections

- Ready-to-use payment plugins

- Custom payment solutions

- Mobile payment systems

Businesses should consider these factors when choosing payment tech:

- Transaction fees and pricing

- Processing speed requirements

- Security compliance needs

- Integration complexity

- Customer payment preferences

“Customized payment solutions can increase conversion rates by up to 3x when properly implemented” – EnactSoft Client Success Data

Security and Compliance Requirements

Digital payments need strong security measures to protect customer data and money. Payment gateways must follow strict rules to keep transactions safe.

Essential Security Features

Every payment system needs these core security elements:

- End-to-end encryption for all transaction data

- Two-factor authentication (2FA) for user accounts

- Tokenization to protect card details

- Real-time fraud detection systems

- Regular security audits and testing

Tokenization turns sensitive card data into random codes. This keeps customer information safe even if hackers break in.

“Our fraud detection system stopped over 98% of suspicious transactions in 2026, saving clients an average of $2.3 million in potential losses.”

Compliance Standards

Payment processors must follow these key regulations:

- PCI DSS – Rules for handling credit card data

- GDPR – Data protection for European customers

- AML – Stops money laundering

- KYC – Verifies customer identity

| Security Level | Features Required | Update Frequency |

|---|---|---|

| Basic | SSL, 2FA, Encryption | Monthly |

| Advanced | AI Fraud Detection, Biometrics | Weekly |

| Enterprise | Custom Security, 24/7 Monitoring | Daily |

Payment security needs regular updates. Hackers create new threats every day.

Implementation Steps

- Run a security audit of current systems

- Update all software to latest versions

- Train staff on security protocols

- Test security measures regularly

- Document all security processes

Quick Tip: Check security certificates monthly. Expired certificates can stop payments from working.

“Regular security updates reduced payment fraud by 76% across our client base in 2026.”

Smart payment gateways use AI to spot unusual patterns. This stops most fraud before it happens.

Keep backup systems ready. If one payment method fails, others should work right away.

Test your security system often. Try to break in like a hacker would. Fix any weak spots you find.

Remember that security rules change often. Stay current with new laws and safety standards.

Integration and Implementation

Technical Integration Steps

Digital payments need careful setup to work smoothly. Let’s break down the key steps that make integration successful.

- API Configuration

- Set up secure API endpoints

- Generate unique API keys

- Test API responses

- Payment Gateway Setup

- Choose between hosted or direct integration

- Configure webhook notifications

- Set up error handling protocols

- Security Implementation

- Enable SSL encryption

- Set up tokenization

- Implement 3D Secure 2.0

A major bank recently cut integration time by 60% using pre-built connectors. They now process 100,000 transactions daily.

Best Practices for Implementation

Success in digital payment integration comes from following proven methods. Here are the key practices to follow:

- Testing Protocol

- Run sandbox testing first

- Test with small transaction amounts

- Verify error messages and responses

- Security Measures

- Use strong encryption (TLS 1.3)

- Set up fraud detection rules

- Monitor transactions in real-time

- User Experience

- Create clear payment flows

- Add helpful error messages

- Keep checkout steps minimal

“Our payment processing time dropped from 3 seconds to 0.8 seconds after optimizing the integration setup.” – Leading e-commerce platform, 2026

Real-world success comes from careful planning. A food delivery app saw 40% fewer payment failures after following these steps.

| Integration Type | Setup Time | Best For |

|---|---|---|

| Direct API | 2-3 weeks | Large enterprises |

| Hosted checkout | 2-3 days | Small businesses |

| Hybrid solution | 1-2 weeks | Mid-sized companies |

Testing is vital for smooth payment processing. Run these basic checks:

- Process test transactions

- Check refund workflows

- Verify payment confirmations

- Test error scenarios

Keep your system current with regular updates. Payment systems change often, and staying current helps prevent issues.

Track these key metrics after launch:

- Transaction success rate

- Average processing time

- Error frequency

- Customer feedback

Remember to plan for growth. Your payment system should handle 10x your current volume without issues.

Cost Analysis and ROI

Cost Analysis and ROI Overview

Digital payments come with both direct and hidden costs that affect your bottom line. Let’s break down the key numbers.

A typical payment gateway charges 2.9% + $0.30 per transaction. This adds up fast for high-volume businesses.

> According to industry data, businesses processing $100,000 monthly in digital payments spend between $2,900-3,500 on transaction fees alone.

Here’s what impacts your total cost:

- Processing fees (per-transaction)

- Monthly gateway fees

- Setup and integration costs

- Security compliance expenses

- Chargeback handling fees

Key Considerations

Smart businesses look at the full ROI picture, not just the costs. Here’s what to track:

- Sales boost from offering multiple payment options

- Time saved on manual payment processing

- Reduced error rates and reconciliation costs

- Lower fraud losses with better security

Real ROI comes from choosing the right payment mix for your business size:

Consider these success metrics when measuring ROI:

- Cart abandonment rate drop (typically 20-30%)

- Customer satisfaction increase (15-25% average)

- Processing time reduction (up to 80%)

> A mid-sized retail client saw their payment processing costs drop 35% after optimizing their gateway mix while increasing sales by 28%.

Track these monthly costs against your baseline:

- Total processing fees

- Chargeback rates and costs

- Staff time spent on payment tasks

- Customer support related to payments

Regular cost reviews help spot opportunities to negotiate better rates or switch providers.

Conclusion

As we’ve explored throughout this comprehensive guide, digital payments have become an integral part of modern business operations, transforming how organizations and consumers handle financial transactions. From understanding core technologies to implementing robust security measures, successful digital payment integration requires careful planning and execution.

The key insights we’ve covered demonstrate that effective digital payment implementation hinges on three critical factors: robust security protocols that protect sensitive data, seamless technical integration that ensures smooth operations, and careful cost management that optimizes ROI. Organizations must prioritize compliance requirements while building a secure payment infrastructure that can scale with their growth. The detailed cost analysis reveals that while initial implementation may require significant investment, the long-term benefits of digital payments far outweigh traditional transaction methods.

To begin your digital payment journey, start by assessing your current payment infrastructure, identifying security gaps, and developing a comprehensive implementation roadmap. Consider partnering with experienced payment solution providers who can guide you through the technical integration process while ensuring compliance with industry standards.

Enactsoft’s team of payment integration experts can help you navigate the complexities of digital payment implementation and create a customized solution that meets your specific business needs. Visit our website today to schedule a consultation and learn how we can help transform your payment infrastructure.

The future of payments is digital, and the time to embrace this transformation is now. Take the first step toward modernizing your payment systems and positioning your business for sustainable growth in the digital economy.

Frequently Asked Questions

What are digital payments and how do they work?

Digital payments are electronic transactions that transfer money between parties through digital channels. They work through payment gateways that act as intermediaries between customers, merchants, and banks. When a transaction is initiated, the payment gateway verifies the payment details, checks for sufficient funds, and securely processes the transfer using encryption and authentication protocols.

How can I ensure my digital payment system is secure?

To ensure payment security, implement end-to-end encryption, two-factor authentication, and tokenization. Regular security audits, PCI DSS compliance, and fraud detection systems are essential. Choose payment gateways with strong security track records and maintain up-to-date security protocols. Regular staff training on security best practices helps prevent human error-related breaches.

What’s the difference between payment gateways and payment processors?

Payment gateways are the customer-facing interfaces that collect and encrypt payment information, while payment processors handle the backend communication between banks. Think of the gateway as the digital equivalent of a card terminal, while the processor is the system that routes the transaction through financial networks. Gateways focus on user experience and security, while processors manage the actual money movement.

How much does implementing digital payments typically cost?

Digital payment implementation costs include gateway fees (typically 2.9% + $0.30 per transaction), integration costs ($3,000-$25,000 depending on complexity), monthly maintenance fees ($25-$100), and compliance costs. Additional expenses may include security measures, staff training, and custom feature development. ROI typically becomes positive within 6-12 months for most businesses.

How long does payment integration usually take?

Payment integration typically takes 2-8 weeks, depending on your system’s complexity and requirements. Basic API integration can be completed in 1-2 weeks, while full-scale enterprise implementations may take 2-3 months. This includes API configuration, testing, security implementation, and compliance verification. Planning for adequate testing time is crucial for a smooth launch.

What should I do if a digital payment fails?

When a payment fails, first check the error message for specific causes. Common issues include insufficient funds, incorrect card details, or network problems. Implement automatic retry logic for temporary failures, maintain clear error messages for users, and establish a customer support process for resolution. Keep detailed transaction logs for troubleshooting and consider implementing real-time monitoring.

What are the best practices for payment processing optimization?

Optimize payment processing by implementing smart routing to choose the most efficient processor, using local payment methods for international transactions, and maintaining proper error handling. Regular monitoring of transaction success rates, implementing retry logic for failed payments, and using tokenization for recurring payments are essential. Consider implementing machine learning for fraud detection and transaction optimization.

What are the latest trends in digital payment technologies?

Current digital payment trends include contactless payments, blockchain integration, real-time payment processing, and AI-powered fraud detection. Mobile wallets and QR code payments are gaining popularity, while open banking initiatives are enabling new payment innovations. Biometric authentication and voice-activated payments are emerging as next-generation payment technologies.

Key Takeaways

This comprehensive guide explores the evolving landscape of digital payments, highlighting how modern commerce increasingly relies on digital transaction methods, with 76% of consumers now preferring these solutions. The article outlines essential components of successful digital payment implementation, including core technologies like payment gateways and processors, robust security measures such as end-to-end encryption and fraud detection, and critical compliance requirements like PCI DSS. It provides practical guidance on integration strategies, cost considerations, and ROI analysis, emphasizing that while initial implementation requires significant investment in security and infrastructure, the long-term benefits include faster processing times, reduced fraud rates, and improved customer satisfaction. The guide serves as a roadmap for businesses of all sizes looking to modernize their payment systems, offering insights into best practices for selection, implementation, and optimization of digital payment solutions in today’s digital-first economy.

References

- McKinsey & Company. (2023). The Future of Payments: Trends, Opportunities and Challenges in Digital Transactions. McKinsey Global Institute.

- Deloitte. (2022). Digital Payments Report: Global Consumer Survey on Payment Methods and Security. Deloitte Digital.

- European Central Bank. (2023). Digital Payment Systems: Infrastructure, Innovation, and Policy Implications. ECB Working Paper Series, No. 2789.

- Lee, J., & Chen, M. (2023). Understanding Modern Payment Technologies: From Mobile Wallets to Cryptocurrency. Journal of Financial Technology, 15(2), 78-96.

- World Bank Group. (2022). Global Payment Systems Survey (GPSS): Digital Payment Adoption and Infrastructure. World Bank Publications.

- Kumar, S., & Smith, R. (2023). Security Frameworks in Digital Payment Ecosystems: A Comprehensive Analysis. International Journal of Cybersecurity, 8(4), 412-429.

- PwC. (2023). The Evolution of Digital Payments: Market Analysis and Future Projections 2023-2028. PricewaterhouseCoopers Financial Services.

Leave a Reply